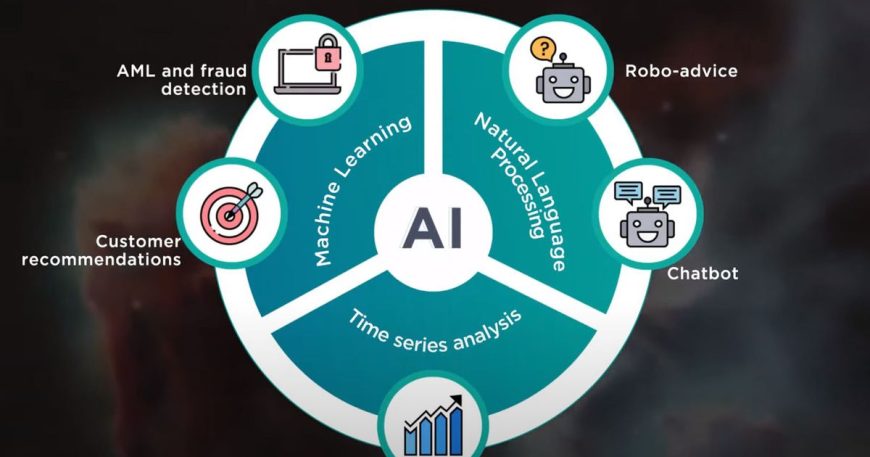

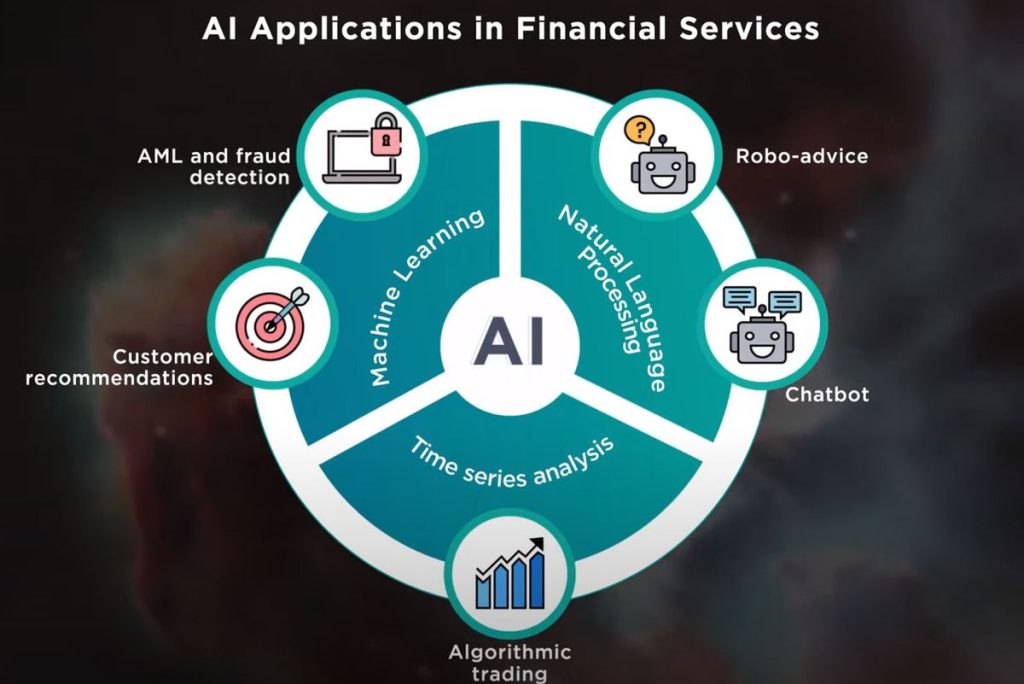

Artificial Intelligence (AI) is revolutionizing industries across the globe—and the financial sector is no exception. As financial institutions seek to improve efficiency, enhance customer experience, and make smarter decisions, AI has emerged as a powerful enabler of innovation and competitive advantage.

1. AI in Fraud Detection and Risk Management

One of the most critical applications of AI in finance is fraud detection. Machine learning algorithms analyze vast volumes of transactional data in real time to identify suspicious activities and prevent fraud. By recognizing patterns that deviate from the norm, AI systems can flag unusual behavior, allowing financial institutions to act swiftly.

In risk management, AI tools assess credit risk, market risk, and operational risk more accurately. AI models can analyze customer history, financial behavior, and broader market trends to predict potential defaults or market downturns, helping institutions mitigate losses before they occur.

2. Algorithmic Trading and Investment Management

AI has revolutionized trading through the development of algorithmic trading systems. These systems use historical data, market indicators, and real-time news to make split-second decisions, optimizing trading strategies for better returns.

Similarly, robo-advisors—AI-driven platforms that offer financial advice—are transforming investment management. These tools consider an individual’s risk profile, investment goals, and market data to recommend tailored investment portfolios, often at lower costs than traditional advisors.

3. Customer Service and Personalization

AI-powered chatbots and virtual assistants have redefined customer service in banking and finance. These tools can handle customer queries 24/7, resolve issues, and even guide users through financial transactions.

Moreover, AI enables hyper-personalization by analyzing customer data and behavior. Banks can now offer customized financial products, anticipate customer needs, and deliver personalized communication, improving customer satisfaction and loyalty.

4. Process Automation and Operational Efficiency

AI and Robotic Process Automation (RPA) are streamlining repetitive, time-consuming tasks such as data entry, compliance checks, and reporting. This not only reduces operational costs but also minimizes errors and frees up human resources for higher-value tasks.

For instance, AI can automate KYC (Know Your Customer) processes, monitor compliance with regulatory requirements, and generate real-time financial reports, enhancing both speed and accuracy.

5. Credit Scoring and Lending

Traditional credit scoring methods often exclude individuals without a significant credit history. AI introduces alternative credit scoring by analyzing non-traditional data such as utility payments, mobile phone usage, and social media behavior, making financial services more inclusive.

Lenders can use AI to assess creditworthiness more comprehensively, reducing default rates and extending credit access to underbanked populations.

6. Challenges and Ethical Considerations

While the benefits of AI in finance are immense, challenges remain. Data privacy, algorithmic bias, and lack of transparency in AI decision-making are significant concerns. Financial institutions must adopt robust governance frameworks to ensure ethical use of AI, maintain regulatory compliance, and build trust with stakeholders.

Conclusion

Artificial Intelligence is not just a technological trend—it is reshaping the future of finance. From fraud detection to customer engagement and investment strategy, AI offers financial institutions the tools to operate smarter, faster, and more securely. As the technology evolves, those who embrace AI responsibly will lead the way in delivering value-driven, inclusive, and innovative financial services.

RKCO East Africa Consulting is your trusted source for the most up-to-date information and industry insights.