In today’s rapidly evolving business landscape, organizations are facing a more complex and interconnected risk environment than ever before. Traditional risk management methods, while still valuable, are often too slow, reactive, and resource-intensive to keep pace with emerging threats. That’s where Artificial Intelligence (AI) and automation come in—revolutionizing how companies identify, assess, and mitigate risks in real time.

The Shift from Reactive to Proactive Risk Management

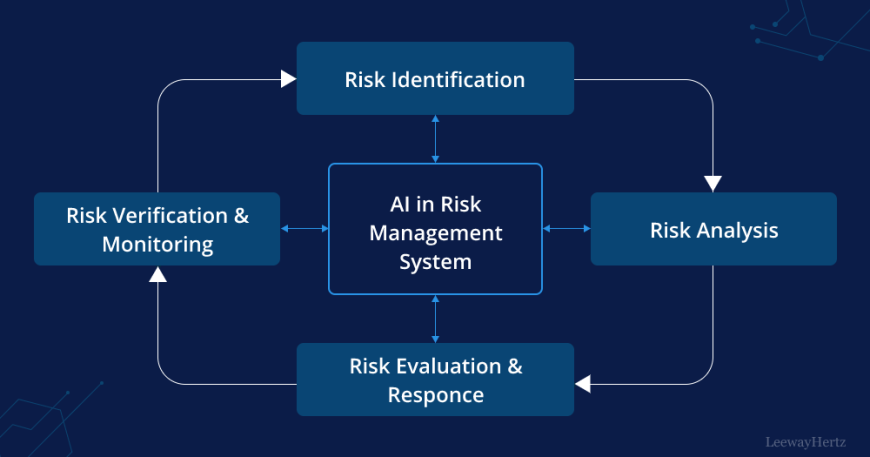

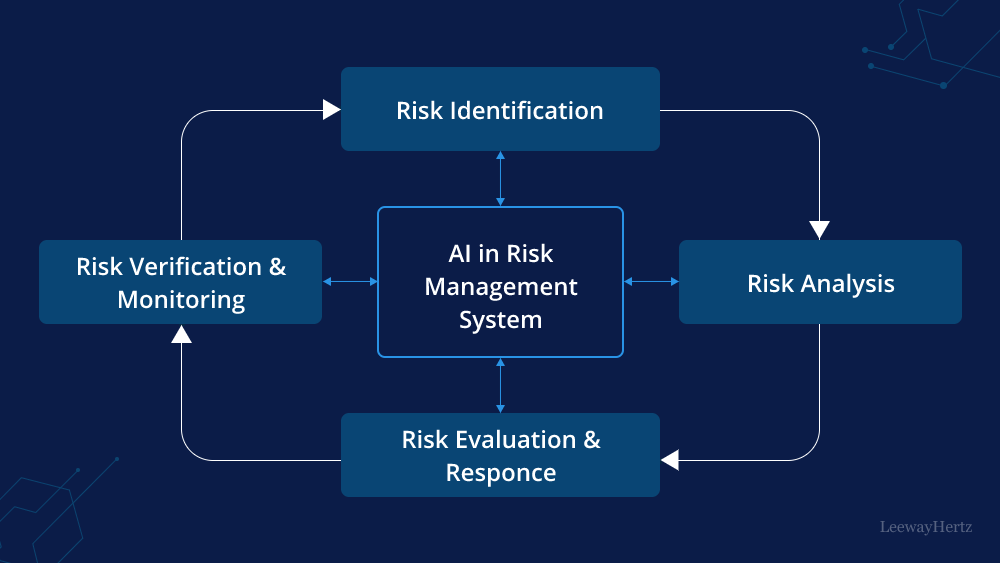

Historically, risk management has largely been reactive—addressing issues after they occur. However, with the rise of AI and automation, organizations can now take a more proactive and predictive approach. Machine learning algorithms can analyze vast datasets to identify patterns, forecast potential disruptions, and suggest preventive actions before issues escalate.

For example, AI-driven tools can monitor global supply chains and flag potential disruptions due to geopolitical tensions, climate-related events, or market fluctuations. This allows businesses to act quickly, adjust their strategies, and avoid costly downtime.

Key Benefits of AI and Automation in Risk Management

1. Real-Time Risk Monitoring

AI systems can continuously monitor data from internal systems, external sources, and social media to detect anomalies and potential threats as they happen. This enables a faster and more effective response.

2. Enhanced Data Analysis

Risk professionals often struggle with large volumes of data. AI simplifies this by processing and analyzing data at a speed and scale no human team could match—turning raw information into actionable insights.

3. Improved Decision-Making

By leveraging predictive analytics, organizations can anticipate future risks and make informed decisions. AI models help prioritize risks based on severity and likelihood, enabling better allocation of resources.

4. Automation of Routine Tasks

Tasks such as compliance checks, document review, and audit preparation can be automated, reducing human error and freeing up teams to focus on strategic risk planning.

5. Continuous Compliance Monitoring

AI-powered compliance solutions can track regulatory changes across regions and industries, ensuring organizations stay up to date with minimal manual effort—particularly crucial in highly regulated sectors.

Challenges and Considerations

While the benefits are compelling, implementing AI and automation in risk management isn’t without its challenges. Organizations must address:

- Data Quality: AI is only as effective as the data it’s fed. Ensuring clean, structured, and relevant data is critical.

- Cybersecurity Risks: Increased digitalization can introduce new vulnerabilities. Strong cybersecurity frameworks must be in place.

- Ethical Concerns and Bias: AI systems must be designed to avoid reinforcing biases or making opaque decisions without human oversight.

- Skilled Talent: Companies need professionals who can understand both risk management and emerging technologies.

The Future of Risk Management

As AI and automation technologies mature, their role in risk management will only grow. Forward-thinking organizations are already embedding these tools into their Enterprise Risk Management (ERM) systems to build agility and resilience.

At RKCO East Africa Consulting, we help organizations stay ahead by integrating smart risk management practices that align with the digital age. Whether you’re just starting your automation journey or looking to optimize your existing risk framework, our team is here to guide you every step of the way.

Interested in modernizing your risk management approach?

Contact us today to learn how AI and automation can enhance your organization’s resilience and performance.